Advisor as a PM

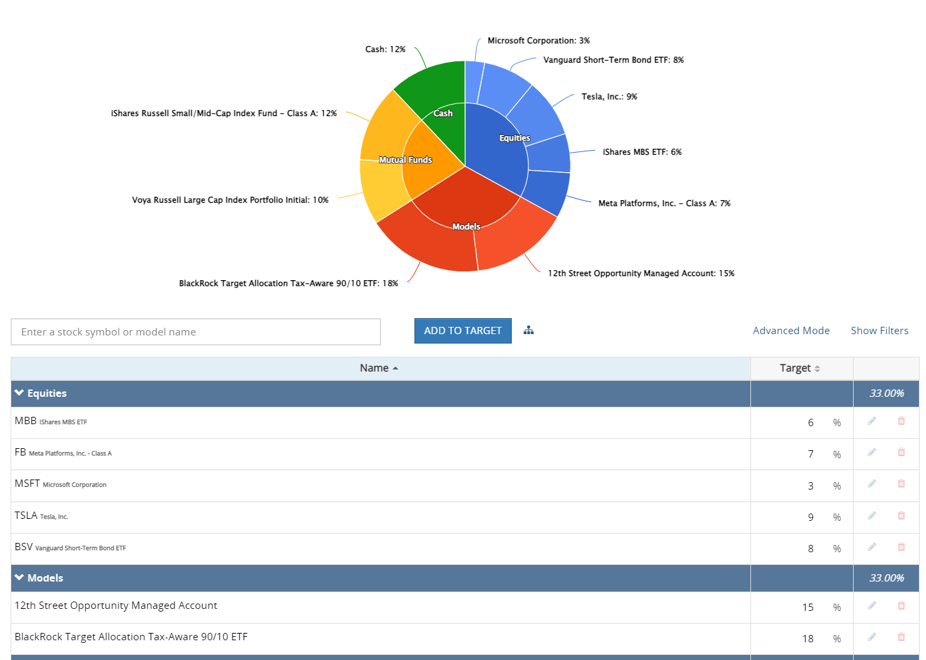

The SMArtX platform provides complete functionality to advisors who create their own internal portfolios for clients. These portfolios can consist of basically any listed security they are able to access through their respective custodian, as well as any of the third-party investment strategies available on SMArtX via UMA. Each portfolio can be saved and allocated to one or more client accounts, with the portfolio being managed from one centralized location.

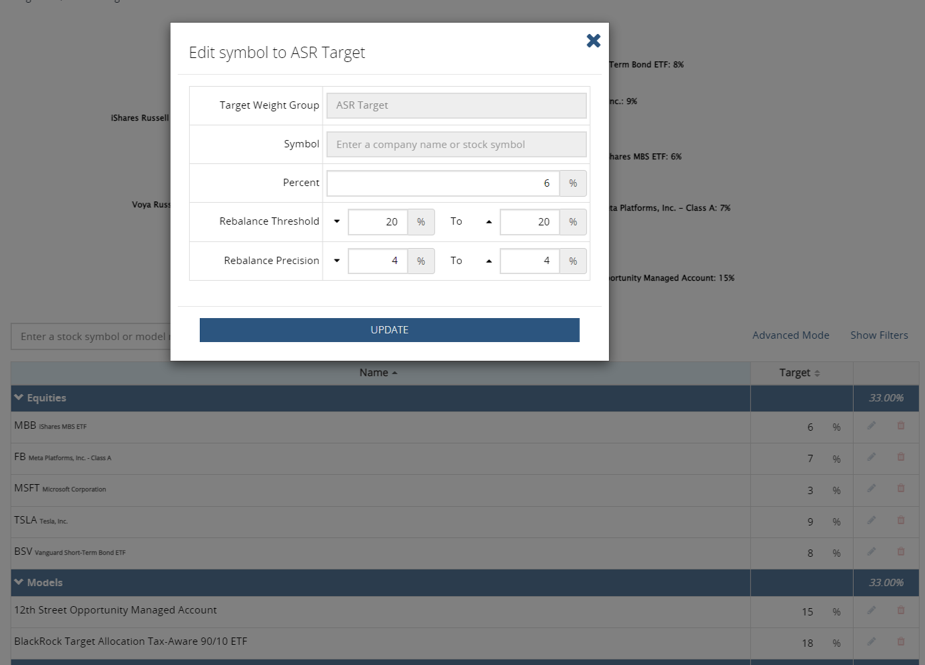

A key element to the Advisor as a PM functionality is the centralized interface for managing holdings. Each one is given a percent weighting and the ability to manage the drift of this weighting. Custom settings can be applied for the position threshold, which dictates how much the position can move both to the upside and the downside, and to what level of precision the position is returned.

As an example, a 10% position could be given a 50% upside parameter and a 20% downside parameter. This enables ‘winners to run’ and downside movements to capture a lower cost basis. Then, the precision parameters will bring them back into line. For the upside, it could be a simple haircut from 15% back to 12.5% (vs the original 10%) but for the downside, it could be right back up from 8% to the 10% allocation.

When assigning a portfolio to an account, the advisor can simply select it within the accounts page and the rebalancer automatically loads all the relevant trades for review and approval. All trades are executed by SMArtX within minutes as the relevant custodian(s). Advisors can assign a portfolio to one or multiple accounts and manage them all from one Advisor as a PM page.