Trading Solutions

SMArtX Advisory Solutions was originally created to maintain model portfolios of long/short hedge funds directly in brokerage accounts. As a result, SMArtX’s trading systems and trade desk trade all day, every day¹ to deliver actively traded strategies to our client’s accounts with as little lag time as possible. This helps to ensure that a client’s account is actually in line with the investment strategy, and is not influenced by time delays.

The idea that an advisor would make a decision to get out of a position or an investment strategy on Monday, only for their clients to actually be out of it on Tuesday or Wednesday needlessly exposes clients to significant market fluctuations. The same goes for a third party investment manager who makes the call to enter or exit a position, only for it to be executed hours or days later. This type of technological stagnation is equivalent to an illiquid position which, on top of an already volatile market situation, inherently disadvantages clients.

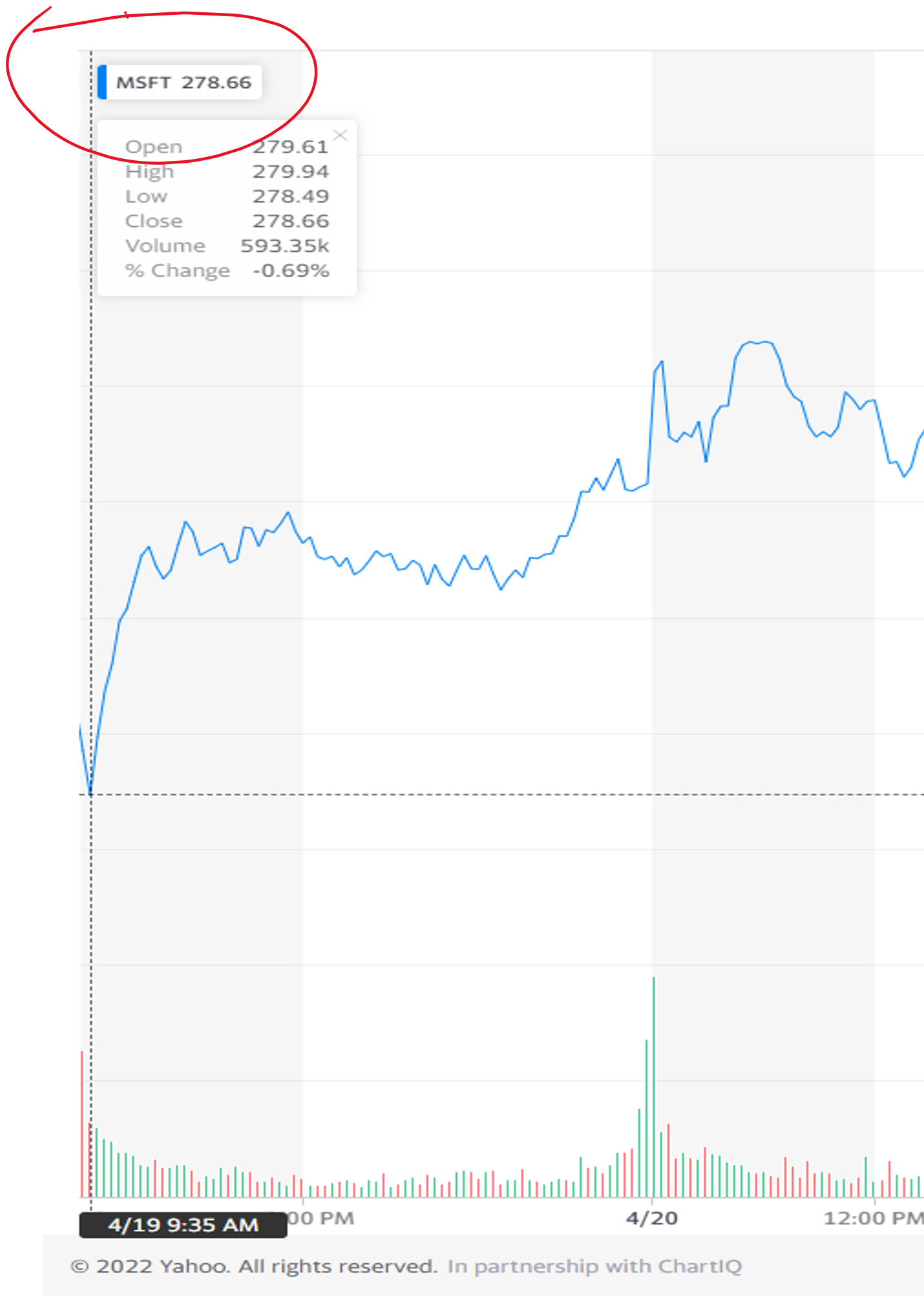

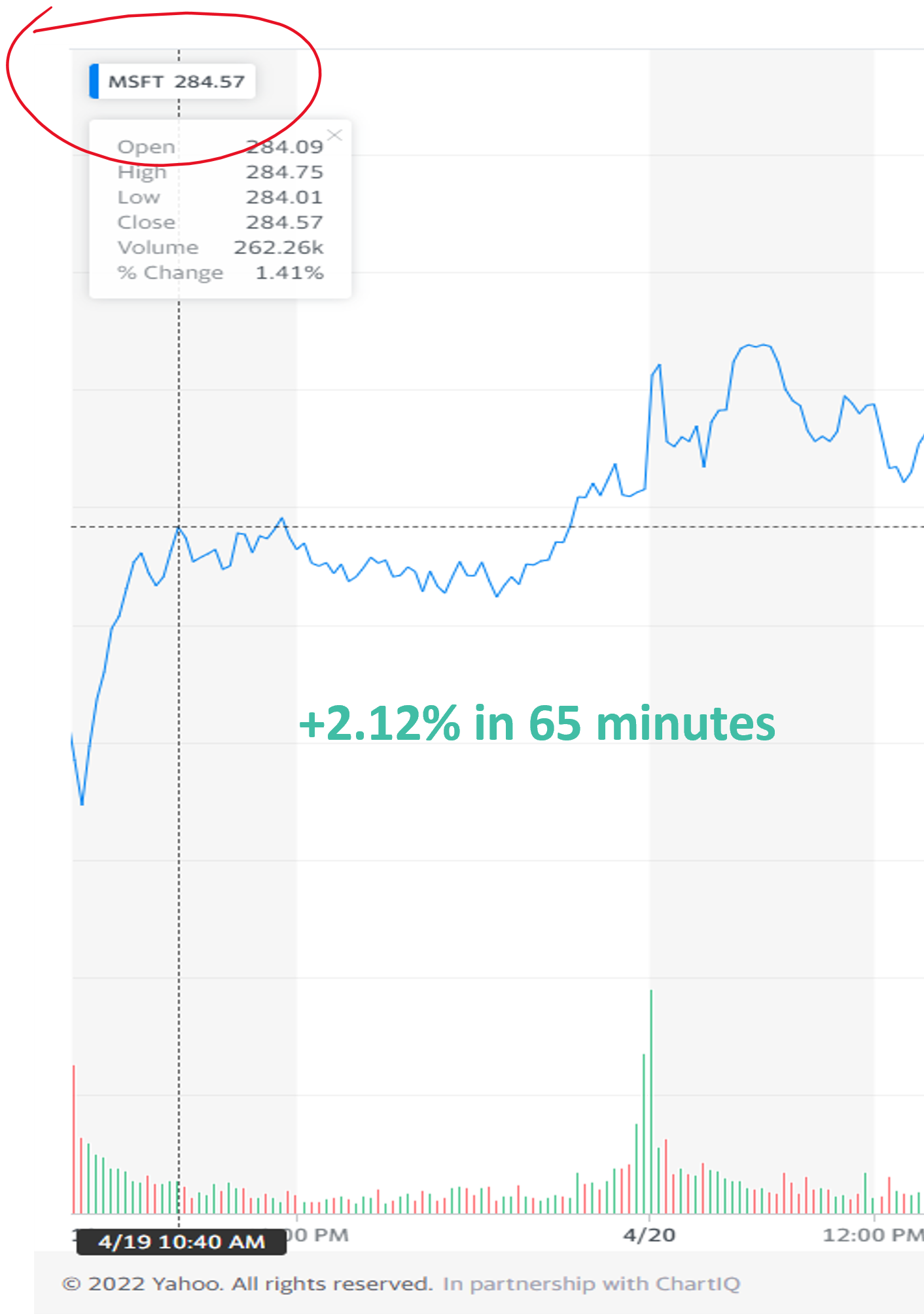

To better understand the effects of time delays on trading, let’s take a look below at the price of Microsoft (‘MSFT’) on April 19th, 2022. The first chart shows it is trading at a price of $278.66 at 9:35am. A short 65 minutes later, and the price has jumped to $284.57, a move of 2.12%. By 9:35am the next day, the price is $288.04, a 3.37% increase in 24 hours. Even if MSFT where only a 5% position, by trading it day later, the account missed out on 17 basis points of appreciation, and this is just one position across one trading day. Over the course of a year, this ‘opportunity lost’ compounds out to hundreds of basis points, which would easily cover the cost of modern trading tools, the advisor’s fee, and then some.

3.37%

in

24 hours.

In short, the modern markets move too fast and are too volatile for anything except modern-day tools. The inability to allocate or liquidate a client’s account for hours, let alone a few days, can significantly detract from a client’s portfolio performance, thereby negatively affecting both the client and the advisor.

¹ During regular trading days and regular trading hours