Stop juggling tools and start dominating the market. SMArtY is your one-stop shop for smarter, smoother, and more profitable portfolio management.

DESIGNED FOR ADVISORS, POWERED BY SMArtX

SMArtY is the only manager-sponsored strategist platform built to let advisors harness powerful managed-account capabilities, tax-focused investing, and cost-effective investment operations solutions without a hefty price tag.

ACCESS MODEL STRATEGIES FROM WORLD-CLASS FIRMS

CONTACT US

ACCESS TAMP-INSPIRED FEATURES

Built on the same award-winning platform as SMArtX, SMArtY gives advisors the same UMA access to leading asset managers, intraday trading, automated rebalancer, tax harvesting, billing, cash management, and tax impact features without the cost of a typical turn-key asset management platform (TAMP). Plus, we provide you with the ability to white label, conduct sleeve-level reconciliation, and provide comprehensive reports.

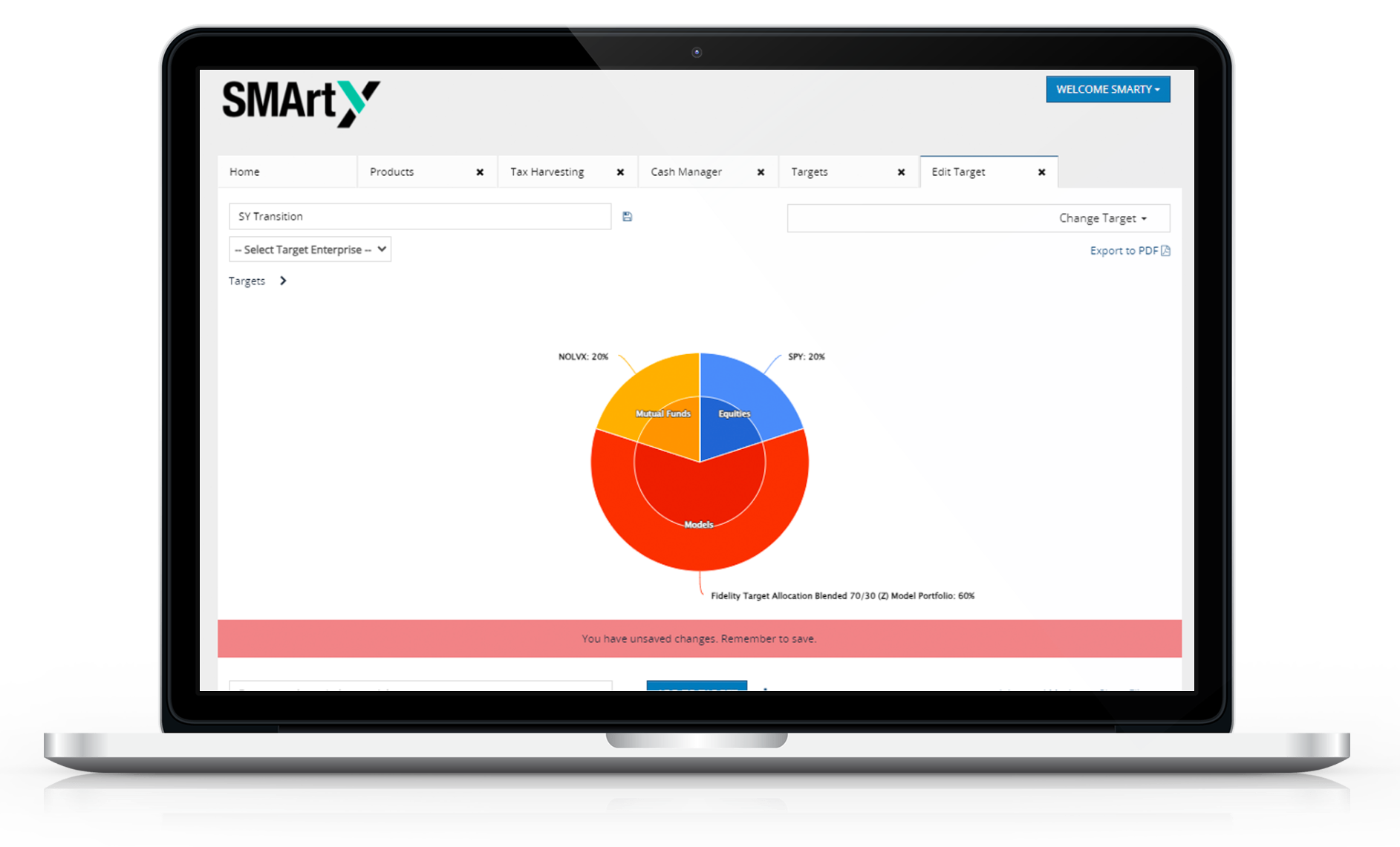

Unmatched UMA Capabilities

Automate your workflow & select model portfolios in a unified managed account (UMA) structure with sleeve-level reporting

Tax-Focused Investing

Access the latest world-class tax technology for efficient account transition

Cost-Effective Investment Operations

Focus on revenue-producing activities without the historical high cost of a traditional TAMP

OUTSOURCING BUILT FOR MODERN ADVISORS & GROWING FIRMS

SMArtY is built for independent and fee-sensitive advisors looking to optimize their cost structure and access institutional-quality investments while minimizing trading, investment, and operational burdens. Advisors who wish to scale their business and focus on high-value, revenue-generating activities benefit from moving to the SMArtY platform.

BOOST EFFICIENCY & CLIENT SATISFACTION

Free up time for clients and strategy with outsourcing — and keep costs low? There is a way. Learn how in our eBook.

READY TO BUILD SMARTER PORTFOLIOS?